Saver – Spender – Wealth Creator

Secrets to Buy, Borrow and Pay Smarter

Secrets of a Wealth Creator: How to Buy, Borrow, and Pay Smarter

Let’s face it, we all buy things that we will need for our entire life. It’s not necessarily what we buy, but rather the way we choose to pay for them that can have a lasting impact on our financial well being. Especially those things we call Major Capital Purchases. These are things that cannot be paid for in full with our regular monthly cash flow. Certainly things like cars, vacations, weddings are major but a new set of tires for many Canadians could be a major capital purchase as well. If you can’t pay for it in full you are going to have to finance it.

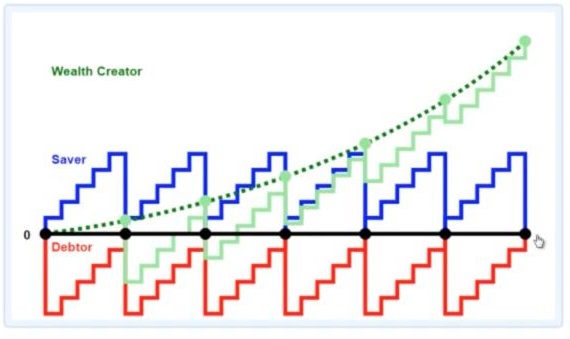

Let’s take a closer look at this with the graph below:

The first thing I want you to notice is the black line in the center. This is the Zero Line, and represents the point at which a person has nothing or owes nothing. When you owe more than you have accumulated you are below the zero line. Unfortunately living above the zero line takes more than a good job.

Let’s begin talking about The Debtor (shown in Red)

The Debtor doesn’t have any savings or resources and is forced into borrowing. They borrow the money against their future earnings, and work toward paying it off and getting back to zero. They hope to have finished paying back what they owe before another need arises. They spend their lives working to pay for what they have already spent plus interest. The only way they can support their lifestyle depends on money they have yet to earn. This obligation on future earnings is one of the biggest problems with debt. It can be very depressing when you can’t see any way to even getting back to zero. Another difficulty is that when you become a debtor to a creditor, you lose control. The creditor is then in control of your resources, not you.

The Saver (shown in blue)

The Saver, being well aware of the wealth transfers inherent in borrowing at interest, will postpone a purchase until they have saved enough to pay cash in full, up front. However, at the same time they make a purchase they also consume their savings and move back toward that zero line. A very precarious position indeed. A single unforeseen circumstance could lead to depleting their savings bringing them closer to the zero line. The saver constantly moves from having access to money and needing to save, to getting back to where they were before they had to spend their savings. They do not like to pay interest, so they drain their accounts and kill compounding each time they do this.

Paying cash seems to be the best way to pay for things because it avoids the necessity to pay interest, but to pay cash you must also give up the ability to earn interest on those same dollars.

Another problem with paying cash is that first, you must save it which is not necessarily an easy thing to do. Depending on where you are saving those dollars, the government may also require that you pay taxes on the growth of that money. And when you do make a purchase not only do you consume those savings, but you also negate the ability of those dollars to earn interest because they have been spent. Many people choose to pay cash in order to avoid paying interest to a lender, which seems smart. However, the part that is often missed is that they are also losing interest they could have earned had they not had to pull dollars out of the account to make a purchase in the first place. But it’s not possible to keep the dollars in the account earning interest and still make the purchase, is it?

The Wealth Creator (shown in green)

The Wealth Creator utilizes a unique approach. They also save, but when it is time to make a purchase they use their savings as collateral to secure a loan, preferably at a lower interest rate than they are earning on their money. Now, there are a couple of key benefits here. The first is that this strategy keeps you from having to deplete your savings to make a purchase. At the same time, it allows those savings to continue to compound interest without interruption. Secondly, while the Wealth Creator does pay interest on the loan, they can often do so at negotiated rates. As the loan is repaid, the amount of savings available to be collateralized increases proportionately until the loan obligation is met. Compound interest works best over time uninterrupted. Resetting compounding on dollars we remove from accounts that are earning interest is not an efficient purchasing strategy.

We all want to make the most of the resources available to us; to be as efficient as we can while also avoiding wealth transfers. Once a decision has been made to part with our dollars, it is permanent. Since we can never have those dollars back again, it makes sense to spend them wisely. To spend them in a way that fosters the creation of wealth, not the relinquishing of it.

Registered Plans The Questions You Should Ask

You Finance Everything You Buy

Spender-Saver-Wealth Creator

SEEKING EXPERT FINANCIAL ADVICE?

At McGuire Financial, since 1996, we have been offering you a wide array of financial services, ranging from financial planning, estate planning, debt strategies, and much more. From Business Owners, Professionals, Families, and Young Entrepreneurs. Talk to one of Certified Financial Planners or Certified Infinite Banking Experts right now at:

Edmonton (780) 462-1289

Calgary (403) 538-6898

British Columbia (778) 738-8321

Ontario (647) 417-0601